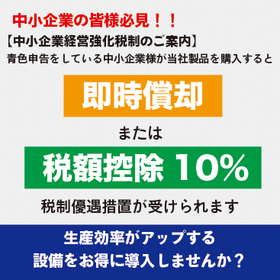

A must-see for small and medium-sized enterprises! Why not take advantage of tax incentives to invest in equipment and streamline operations?

DUPLODEC

What is the Small and Medium-sized Enterprise Management Enhancement Tax System? This tax system provides benefits such as immediate depreciation or a tax credit of 10% of the acquisition cost when small and medium-sized enterprises acquire new equipment based on a management improvement plan certified under the Small and Medium-sized Enterprise Management Enhancement Act and use it for designated businesses. [Application Deadline] Products acquired by March 31, 2025. Some of our products are also eligible for this tax system. We encourage you to take advantage of this tax benefit and consider making capital investments.

Related Links

We are introducing products that are eligible for the Small and Medium Enterprise Management Enhancement Tax System.