news list

1~9 item / All 9 items

-

[Book Publication] VALUE UP: Understanding Industry-Specific M&A and Corporate Value Enhancement Strategies through Success Stories

★AMANO SCOPE Mr. Shinya Amano & Monozukuri Taro Channel, Recommended by Mr. Monozukuri Taro! "Learn from past cases and you can compete even in your first M&A!" ★ A fully industry-focused M&A consultant explains the challenges and potential of the manufacturing industry! ★ Detailed introduction of methods to enhance corporate value through real case interviews and the latest M&A strategies! ★ Simultaneous release of four titles by industry: "Logistics Industry Edition," "Manufacturing Industry Edition," "Pharmacy Industry Edition," and "Food Industry Edition"! ▼ Recommended for mid-sized and small business owners like these: - Want to know the management strategies of continuously growing companies - Want to achieve significant growth by partnering with listed companies or large corporations - Want to learn detailed M&A cases of companies in the same industry and of similar size - Want to enhance corporate value and conduct M&A under satisfactory conditions and amounts

-

Spica Consulting establishes a new research institution, "Value Up Lab," focused on enhancing corporate value.

Our company will establish a research institution called "Value Up Lab," aimed at analyzing management factors that contribute to enhancing corporate value in five industries: manufacturing, logistics, healthcare, energy, and food, as well as disseminating information on advanced management issues specific to each industry. At the end of September, we plan to release a white paper focused on the five industries as the first publication from "Value Up Lab."

-

Spica Consulting begins offering a diagnostic service to measure employee satisfaction after M&A.

Our company has started offering a diagnostic service to measure employee satisfaction regarding M&A, aimed at supporting smooth PMI between companies that have undergone M&A, starting from June 4th. This service involves surveying employees belonging to the acquired company about their satisfaction with the work environment, interpersonal relationships, and treatment after the M&A. The survey is conducted by our company as a third-party organization, ensuring the anonymity of the employees through the aggregation and analysis of responses. The survey report, created from both quantitative and qualitative perspectives with an objective viewpoint, can not only be used to discover new management challenges but also visualizes the often-invisible strengths of the company, such as corporate culture and communication among employees. This makes it useful as proposal material for potential future acquisition targets.

-

Connecting shining technologies through M&A" Part 1 "The management issues that M&A can solve are not just the absence of successors.

Spica Consulting is a company that provides "Value-Up Consulting" and "Industry-Specific M&A" services. We have entered the capital umbrella of GA Technologies, which has been listed on the Tokyo Stock Exchange Growth Market within a year of its founding. Why did an M&A consulting company choose to partner with a real estate tech company? First, we found that the business models are similar, and by referencing the paths taken by other industries that are ahead, we concluded that the real estate industry and M&A brokerage have closely related business models. Additionally, GA Technologies is the one driving innovation through IT in the real estate industry, which still retains many analog elements. In this way, considering potential partners that can be expected to grow further is positioned as a very important "preparation period." While our capital comes under GA Technologies, all of our management team will continue in their roles, and we have chosen to pursue further corporate growth. We hope to first clarify what resources we lack and understand that "M&A" is a means to acquire those resources.

-

A new research team has been established to aim for the improvement of M&A brokerage service quality using advanced technologies such as AI.

Our company has established a research team aimed at improving the quality of M&A brokerage services starting in March 2024. We will utilize advanced technologies such as AI to support consultants in making more sophisticated proposals. The newly established research team aims to achieve higher quality M&A support by utilizing advanced technologies such as image processing and generative AI to reduce and streamline the complex tasks of consultants.

-

Started providing the "Value-Up BOOK," which explains M&A trends by industry and methods for enhancing stock value.

Starting January 22, 2024, our company will begin offering the "Value Up BOOK," which focuses on four industries: pharmacy, logistics, manufacturing, and energy (LP gas). This is a collection of materials for business owners that explains industry trends, basic knowledge of M&A, M&A case studies for each industry, and methods for value-up consulting (enhancing stock value). Consultants with extensive experience and a proven track record in the industry have carefully selected and created this information to contribute to corporate growth, along with explanations. We will distribute this material for free to business owners who have had individual consultations with us. If you would like the materials, please apply for an individual consultation.

-

On April 19 (Friday), the first "M&A CONSULTANT CAREER MEETUP" will be held to consider a career as an M&A consultant.

Our company held the "M&A CONSULTANT CAREER MEETUP #01" on April 19, 2024, aimed at individuals interested in employment or career changes in the M&A brokerage industry, as well as those looking to advance their careers in M&A consulting. The inaugural event on April 19 was limited to the first 30 participants and featured a networking session themed "The Career of an M&A Consultant: The Past, Present, and Future." The discussion focused on the environment surrounding the job of an "M&A Consultant," the transformation of its image, and the skills that will be necessary for consultants moving forward.

-

At the "Business Succession Planning for the Future" event hosted by the Kawasaki Nakahara Factory Association, our company's director and an M&A consultant took the stage.

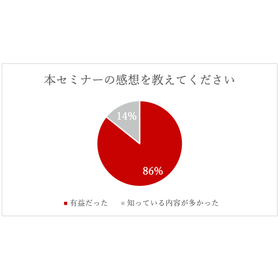

Spica Consulting Co., Ltd. held a seminar on "Developing Business Succession Strategies for Future Preparedness" for members of the Nakahara Factory Association, a general incorporated association. On the day of the event, approximately 20 executives participated, and the survey results showed that 86.6% of attendees found it "beneficial." Additionally, we received comments from participants such as, "I was able to learn the formula for corporate value," "It wasn't directly related to me, but I understood it well," and "The elements were explained clearly in a short amount of time."

-

Spica Consulting changes its fiscal period due to the management integration with GA Technologies - Announcing the new management structure for the third term.

Spica Consulting Co., Ltd. (Headquarters: Minato-ku, Tokyo; Representative Director: Haruo Nakahara), which provides "Value-Up Consulting" to maximize corporate value and "Industry-Specific M&A," has announced a change in its fiscal year following the management integration with GA Technologies, Inc. (Headquarters: Minato-ku, Tokyo; Representative Director, President and CEO: Ryu Higuchi; Securities Code: 3491) in July 2023. Before Change: December Fiscal Year After Change: October Fiscal Year As a result of this change, our company, which was founded on August 23, 2022, will enter its third fiscal period starting November 1, 2023. Currently, we have 16 M&A players, including directors, and we provide value-up consulting that realizes stock value enhancement based on industry insights. Additionally, our company, which offers fully industry-specific M&A, has implemented a management system led by M&A players specializing in various industries, such as manufacturing. We will continue to strengthen our management foundation to support business owners with accurate and in-depth knowledge of each industry and to achieve successful M&A.